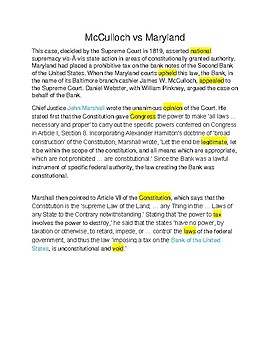

Mcculloch V Maryland Brief Summary. The state of Maryland enacted a tax that would force the United States Bank in Maryland to pay taxes to the state. Maryland of March 6 1819 was a seminal Supreme Court Case that affirmed the right of implied powers that there were powers that the federal government had that were not specifically mentioned in the Constitution but were implied by it.

Supreme Court in 1819 after the state of Maryland placed a heavy tax on a bank chartered by the US. The state of Maryland enacted a tax that would force the United States Bank in Maryland to pay taxes to the state. In addition the Supreme Court found that states are not allowed to make laws that would interfere with congressional.

Supreme Court decision that defined the scope of the US.

James McCulloch defendant head of the Maryland branch of the Bank of the United States Bank refused to pay the tax. Congress passed an act incorporating the Bank of the US. The Bank refused to pay the tax and a lawsuit followed. McCulloch a cashier for the Baltimore Maryland Bank was sued for not complying with the Maryland state tax.